Previous Insights

How Can I Pay for My Parent's Care?

Marianne Smith

With the price of senior care already high and getting more expensive all the time, how can I possibly make ends meet for my parent? Genworth Financial, which produces an annual Cost of Care Survey, puts the 2019 US national median cost for services and facilities as:

Homemaker services: $4,290

Home health aide: $4,385

Adult day health care: $1,625

Assisted living: $4,051

Nursing home (semi-private): $7,513

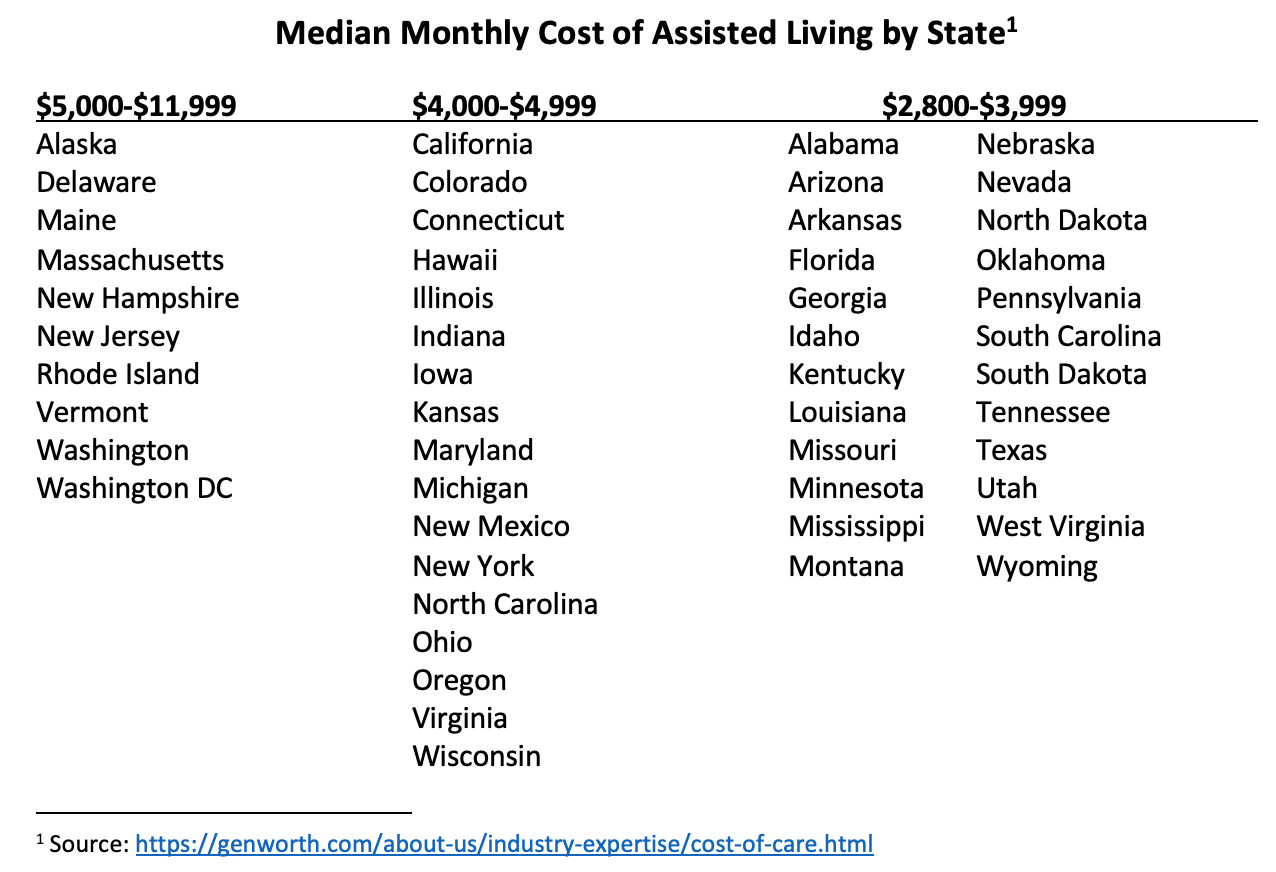

But those prices may be a bit deceptive. Assisted living costs range widely from $2,800 in Missouri to $11,200 in Washington, DC. And

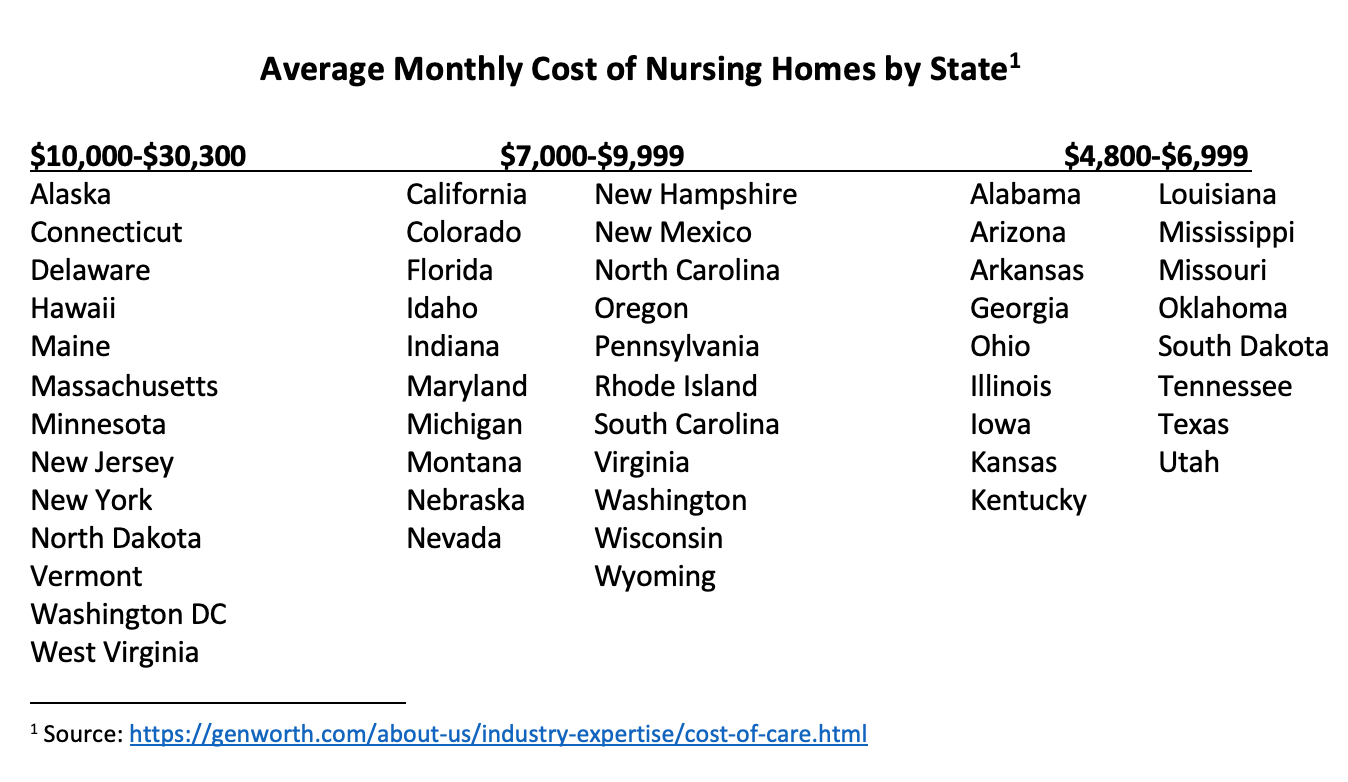

nursing homes are even worse – from $4,800 in Oklahoma and Texas to over $30,000 in Alaska! Per month! (You can find your state in the listing at the bottom of this blog.)

Now, the last thing I want to do is cause you to panic. Instead, let’s look at some of the options that might be available to help defray the cost of your parent’s expenses. All of these resources are covered in more depth on https://allthingsagingparents.com/Financing-and-Government-Programs.php.

One of the first things people think about for help with older adults is Medicare, and while that covers many things (see our overview), in this article we will only discuss what might help long term. Medicare covers in-patient hospital expenses and will only cover a skilled nursing facility short term (under certain circumstances). But they do pay for hospice care for people with an expected prognosis of 6 months or less. If you think your parent qualifies for hospice, please check this out – hospice services help you as much as your parent. Medicare also covers some home health care and durable medical equipment (like wheelchairs, prosthetics, etc.). Finally, Medicare covers some prescription drugs, which will help long term.

Medicaid, on the other hand, is a significant source of funding for long term care, paying for 40% of nursing home care, and 40% of long term in-home services and supports. Covered services might include homemaker services and personal care, home health aides, and respite care. Unfortunately, Medicaid does not pay for assisted living (with rare exceptions), only skilled nursing care or in-home services. Medicaid is designed to help needy people, but there are people who can help (“Medicaid planners”) so that your parent doesn’t have to exhaust his/her entire financial estate to pay for care before Medicaid kicks in. Most states have protection for the income and some assets if one spouse is still living in their home while the other one is in a nursing home. Medicaid is a pretty confusing program, so I strongly recommend you get help from a professional.

For those older adults who served in the military, Veterans Benefits can provide a significant source of funding to help pay for senior care. The caveat is that they have to have served during a time of war. You can see the chart of dates along with our overview. (Some health and medical benefits may be available even if the veteran did not serve during wartime.) A VA pension is based on need and how much assistance the person needs: basic pension, housebound pension, and aid and attendance - the higher the category, the more dependent the person must be. Going through the process of applying for VA benefits is very confusing, so again, I recommend that you contact a professional.

Then there are some insurance options that may help. If your parent is among the 11% of seniors who chose to purchase long term care insurance, great! That will be a great help when they meet the eligibility requirements to access benefits. Sadly, all too often by the time someone realizes they need long term care insurance they no longer qualify to purchase it. There are also some options with your parents’ life insurance. If they no longer feel they need it, or if they cannot afford to pay the premiums, they may be able to sell the policy to an investor for more than the cash value of the policy, but less than the death benefit. This is called a “senior settlement” or “life settlement.” A “viatical settlement” is similar, but only available to terminally ill patients. More information about these insurance options is available here.

Finally, reverse mortgages (see our overview) may be a source of income for your parents. The greatest asset of most older adults is their home and may own that outright, or at least have substantial equity. In a reverse mortgage, your parent retains the title to his/her home until their death and receives monthly payments (or a lump sum) in exchange for the equity in the home. You may want to speak to a reverse mortgage specialist to see if that is the right fit for your parents.

I hope you have seen that there are options to help you navigate the tricky waters of paying for your parents’ care. Your best bet is to connect with professionals who can help you learn more about any of the possibilities we have listed here. Hang in there and keep asking questions until you find some solutions!

The information contained in this website is provided as a service to the Internet community, and does not constitute legal or medical advice. All Things Aging Parents works to provide quality information, but we make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the information contained in or linked to this website. Information should be researched and used in light of the specific circumstances of each case. Because laws and policies are constantly hanging, nothing provided here should be used as a substitute for professional advice.

Senior care is a challenging and constantly changing topic. In order to stay relevant to your needs, ATAP welcomes your comments and suggestions. Please email us at: info@allthingsagingparents.com

All Things Aging Parents helps families during the overwhelming times of changing family dynamics and responsibilities. We don't want to add stress to this process so we offer our information free of commitment. Our sponsors make this possible. Please click here for more information about becoming a sponsor.

Privacy Policy